UMarkets Review 100% Unregulated and Blacklisted Scam Broker

As you know, the Forex market and crypto market are volatile enough where price values change in seconds. The website’s software speed deals with high volatility and will not let you become a victim of market volatility. The high execution speed feature of the company makes it popular in the ranks of traders and investors. As per the details given, it executes trades in 0.012 seconds. Umarkets is not a regulated broker and there are risks involved pertaining to client fund security, among others, when using unregulated brokers to facilitate trading.

Trading Centrals Alpha Generation Indicators can help Umarkets traders better understand market trends and patterns, enabling them to make more informed trading decisions. These indicators can provide valuable insights into market movements, allowing Umarkets traders to potentially stay one step ahead. Umarkets may charge commission fees for fulfilling, modifying, or canceling an order on behalf of its clients. However, if a market order is not fulfilled, no commission fee is usually charged. Reviewing Umarkets terms and conditions to understand the commission fees and any other charges that may apply is essential.

Your capital is at risk

You should consider whether you can afford to take the high risk of losing your money. Trading CFD trades on the Umarkets platform can provide more flexibility than traditional market trades, allowing access to CFD fractional shares, international markets, and short selling. They are commonly used for short to medium-term trades, such as intraday CFD trading, but are high-risk due to their separation from the financial markets. It’s important to note that Umarkets requires users to provide essential documentation to verify their identity during onboarding and routine KYC identity checks.

What is the minimum deposit for umarkets?

The cost of trading depends on different factors like commissions, spread, and margins. Umarkets is owned by Market Solutions Ltd since October 2017, which is also located in Kingstown. The broker has been using the same brand name with a registration out of Belize under the name Maxi Services Ltd. ForexPeaceArmy.com has advertising and affiliate relationships with some of the companies mentioned on this site and may be compensated if readers follow links and sign up.

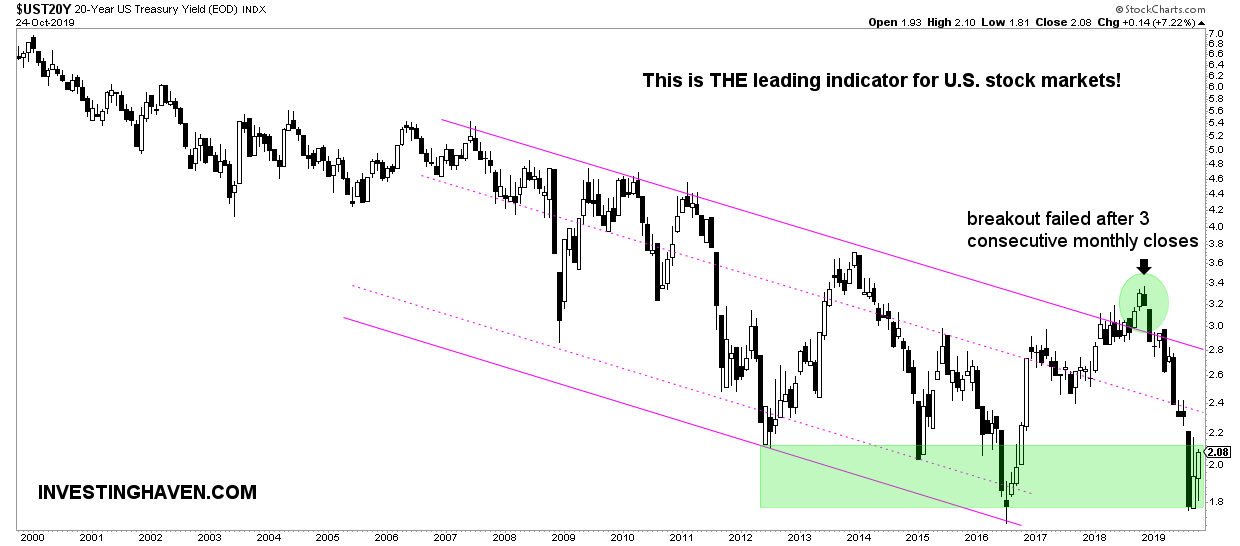

Recession is likely in 2023, but U.S. markets could change course more quickly than investors might assume, RBC Wealth Management suggests – Yahoo Finance

Recession is likely in 2023, but U.S. markets could change course more quickly than investors might assume, RBC Wealth Management suggests.

Posted: Tue, 06 Dec 2022 08:00:00 GMT [source]

Umarkets CFD trading on cryptocurrency assets is not allowed in the United Kingdom as set by the UKs financial regulator the FCA. Check to see if Umarkets CFD cryptocurrency trading is allowed in your region and make sure you undertand the risks fully before trading. Umarkets non-trading fees include a variety of Umarkets brokerage fees and charges that a trader will pay which are not related to buying and selling assets using the Umarkets trading platform. The most common non-trading fees include Umarkets withdrawal fees, Umarkets deposit fees and Umarkets inactivity fees. The majority of Umarkets trading fees, commission is either a flat fee per trade or calculated based on the number of traded shares.

UMarkets Review

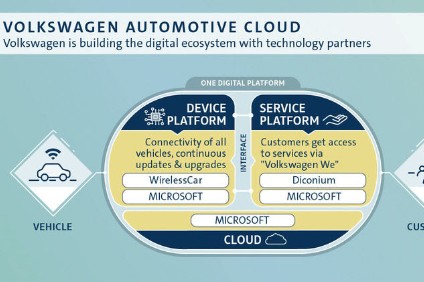

Umarkets also features excellent trading conditions which are available to all and not only an elite class of institutional customers. The tight spreads and fast executions are a great benefit for all traders. The technology embraced by umarkets is among the highest caliber, making sure that it’s fast, reliable, and efficient. Umarkets is a online trading broker with its head office in Bulgaria and provides a variety of tools for online trading. Since its establishment in 2018 they have emerged as a leading player in the industry of online trading. Umarkets has an extremely professional and full-featured trading site that’s focused on forex, indices, metals, shares, commodities.

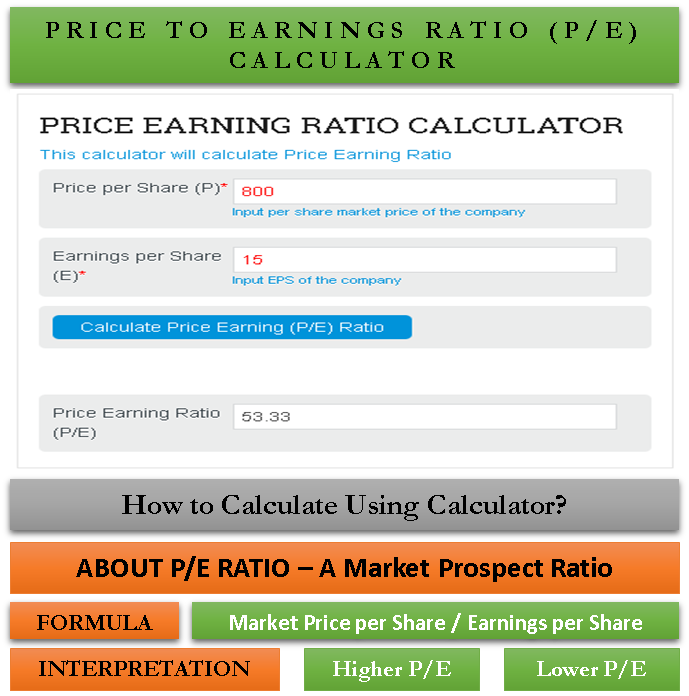

Fundamental analysis, on the other hand, looks at economic and financial factors that influence a business. Fundamental analysis therefore evaluates securities by attempting to measure their intrinsic value. Traders can follow the markets and make wise investment decisions on Umarkets by using the news to help form a strategy when it comes to choosing investments. A Umarkets news trading strategy involves trading based on news and market expectations, both before and following news releases. Traders need to assess the news immediately after it is released and make a quick judgement on how to trade as a result.

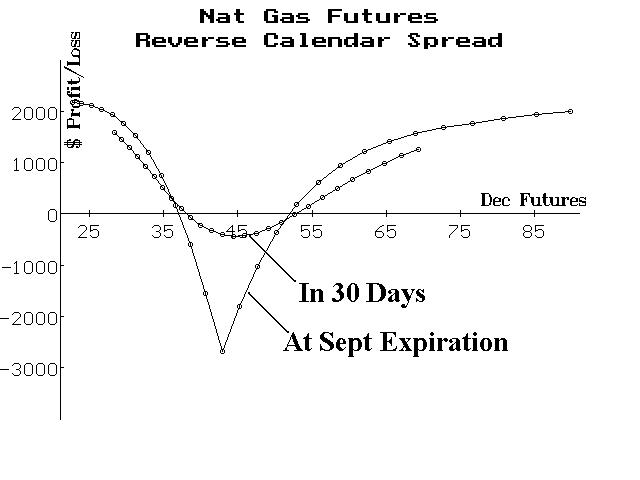

Umarkets Futures Trading

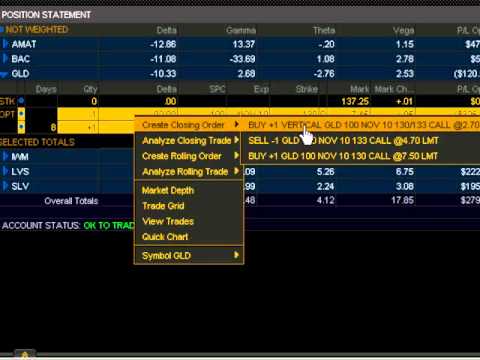

Cryptocurrency trading is not offered by Umarkets, so you will need to find a Umarkets alternative that allows you to buy and sell the underlying cryptocurrency assets. Check to see if CFD cryptocurrency trading is allowed in your region with a Umarkets alternative and make sure you undertand the risks fully before trading. A Umarkets stop-limit order is an order to buy or sell a stock https://forex-reviews.org/umarkets/ that combines the features of a stop order and a limit order. Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specified price (or better). The Umarkets stop-limit order triggers a limit order when a stock price hits the stop level. A Umarkets stop-limit order can be helpful when trading if you are unable to watch your trades all day.

PlayUp Review – Up to $150 in Free Bets 2023 SBR – Sportsbook Review

PlayUp Review – Up to $150 in Free Bets 2023 SBR.

Posted: Sat, 03 Jun 2023 07:00:00 GMT [source]

Events may include indicators such as GDP, the consumer price index (CPI), and the Non-Farm Payroll (NFPs) report. The Umarkets user interface (UI) is what Umarkets traders will see and interact with first when trading with the Umarkets trading platform. The goal of the Umarkets trading UI is to make the Umarkets user’s experience easy and intuitive. The Umarkets application has good user experience and a good level of customer satisfaction. There can also be additional fees, such as inactivity charges, withdrawals and transfers. Make sure that you have enough funds to trade via a Umarkets account.

FXGT Islamic Account

Safety is evaluated by quality and length of the broker’s track record, plus the scope of regulatory standing. Professional traders make portfolios and add a variety of assets; as wise people say, do not put all eggs in one basket. It would be best if you diversified your investments among different assets.

- We understand that informed decisions with Umarkets are the key to successful trading, so we’ve provided this detailed Umarkets review.

- The broker has been using the same brand name with a registration out of Belize under the name Maxi Services Ltd.

- Performing your due diligence and researching the trustworthiness of umarkets, its track record, and reputation is vital.

- Using Autochartist can save Umarkets users time and makes the trading process more efficient.

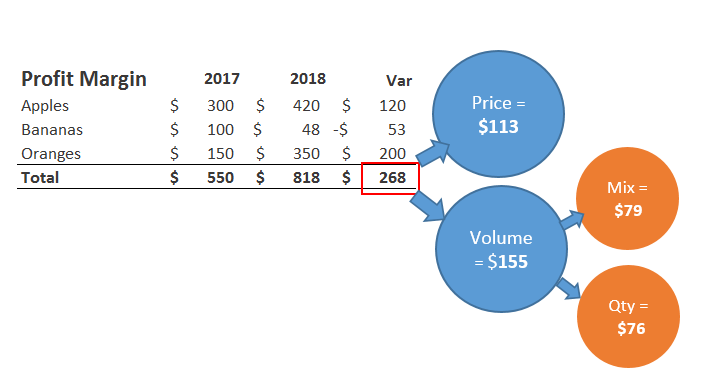

Therefore, before trading, verify the Umarkets trading instruments available and the regulations governing them based on your account holder, location, and chosen platform. In addition, currency conversion fees may apply if the Umarkets withdrawal and receiving currencies differ, adding to the overall transaction costs. The currency conversion fee depends on your base currency, receiving currency, and the 3rd party payment provider that is separate from Umarkets. Awareness of these Umarkets fees and policies can help you plan and budget accordingly and avoid any unpleasant surprises when transferring your Umarkets funds. The asset selection is adequate for most traders, but the pricing environment remains excessive. Traders are also faced with above-average deposit requirements which, given the aforementioned expansion plans, appear out of reach for the target markets.

Through the Demo-Real offer, new traders will earn bonuses for their live trading account. Three analysts publish numerous short fundamental commentaries on a daily basis. They provide a brief overview of ongoing developments, which can impact various assets. A company earnings calendar grants an overview of upcoming earnings, relevant to equity and index CFD traders. Completing the fundamental research tools is the inclusion of an economic calendar.

They hold substantial core capital reserves, making them capable of handling unexpected losses and market volatility without endangering their Umarkets clients’ funds. As a trader, you should feel confident that your financial investments are in good hands with Umarkets. That’s why it’s essential to understand the Umarkets company policies and practices before making any investment decisions. By doing your due diligence and understanding Umarkets platform, you can make informed investment choices that align with your financial goals. So take the time to research Umarkets thoroughly and make the most of your online investing experience. When it comes to online trading with brokers like Umarkets,

carefully review Umarkets as your broker can make or break your success.

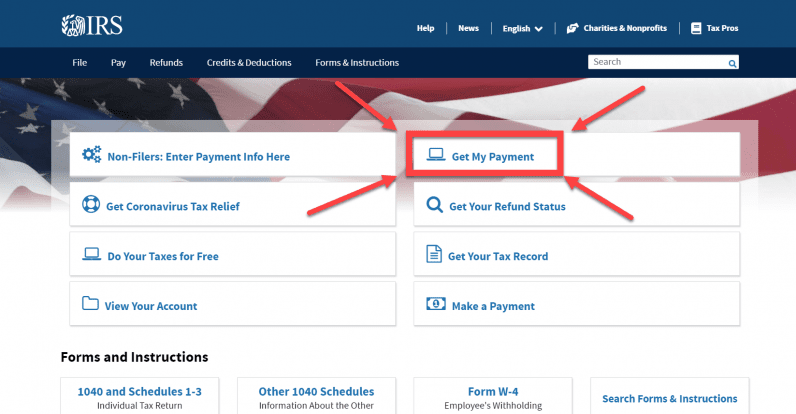

Basically, UMarkets is an online trading platform owned by an offshore company and not regulated. However, UMarkets minimum deposit of $250 is relatively high if you check other regulated brokers that allow you to start from $10. So far, it’s clear that this broker is conducting cyber fraud.

Investors can buy stock in fractional shares by specifying a dollar amount rather than the price of a whole share. # market, limit, stop, stop limit, Good until end of day / canceled. Although Umarkets has a lot of good points Umarkets does not offer the below. Umarkets is regulated by Belize International Financial Services Commission (IFSC). The xCritical platform is a relatively new platform and a good alternative to MT4 and the most used platform at Umarkets.

If you’ve been in the online trading business for as long as I have, you’ll know that regulations and licenses are just a part of many determinants of an online broker’s reliability. You also need to look into the security features to know how safe your funds will be once deposited. The funds are saved in the segregated accounts, which add further layers of security. My experience with the broker was also awesome as I am fully satisfied with its measures for users’ security. Your funds are protected under many layers of security as the dedicated team of the company takes full responsibility for the customers’ funds. Still, if you have any doubt regarding security policies, you can connect with the support team and ask them for further detail.